A Financial Breakdown To Own a RM1 Million House

This article contains figures based on estimation and is susceptible to change.

Many of us wish to someday live in the home of our dreams, however this dream comes with a burdensome price tag. Unfortunately, buying a home isn’t as simple as buying a cup of coffee and there are many elements one has to account for before even considering their options. In our modern age, the property market has drastically changed with factors such as changes in property ownership laws and economic conditions. 10 years ago, a two-story terrace house located in the Petaling area after renovations can be found for around RM450,000, that number has since doubled, closing in at almost a million Ringgit according to PropertyGuru Malaysia. Despite this, it’s unfeasible for everybody to just stop purchasing houses, instead we adapt and manage our finances for the privilege to call someplace home. Buying your first home isn’t exactly something you’d see in your school textbook, so this article intends to dissect the financial aspect of owning a humble abode of RM1 million.

This breakdown takes into account that one is living comfortably and not pinching pennies by eating a cup of plain rice every day to get to the finish line. In other words, we’re looking at this with a realistic lens, with commitments, obligations, survival, entertainment, etc. all in mind.

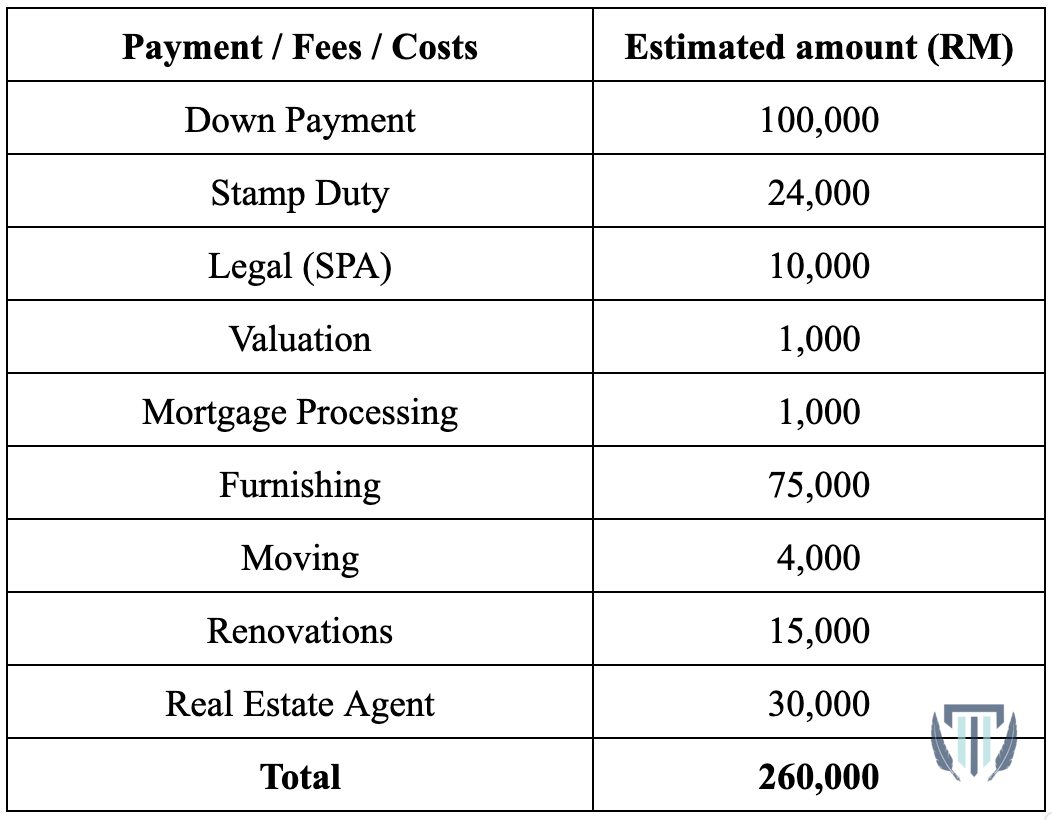

Firstly, we will need to list down several fees a homeowner must bear alongside mortgage application requirements. What is a mortgage exactly? It’s a loan that banks grant for property purchases and is infamous for having a long repayment period, after all it is hundreds of thousands of Ringgits. Most of us simply do not have heaps of money sitting in the bank and to buy a house can take decades of saving, so a mortgage is the route the majority takes. Additionally, other fees such as stamp duties, renovation costs and down payments will also add up to the amount to be paid up front. With all that said and done, the list of upfront payments to account for are as follows: down payment, stamp duty, renovations, furnishing, real estate agent fees, mortgage arrangement fees, legal fees, home insurance, valuation fees and moving costs.

Part 1: The legal system and banks

The down payment operates exactly like a deposit, you will need to pay a certain amount upfront to even qualify to own the house. For first-time home buyers, the government has set it to 10% of the property’s value. In the case of a home valued at 1 million Ringgit, you’d have to pay RM100,000 up front. The remaining RM900,000 would be covered by a mortgage which will be later explained in detail to calculate if it's possible to be eligible for the loan.

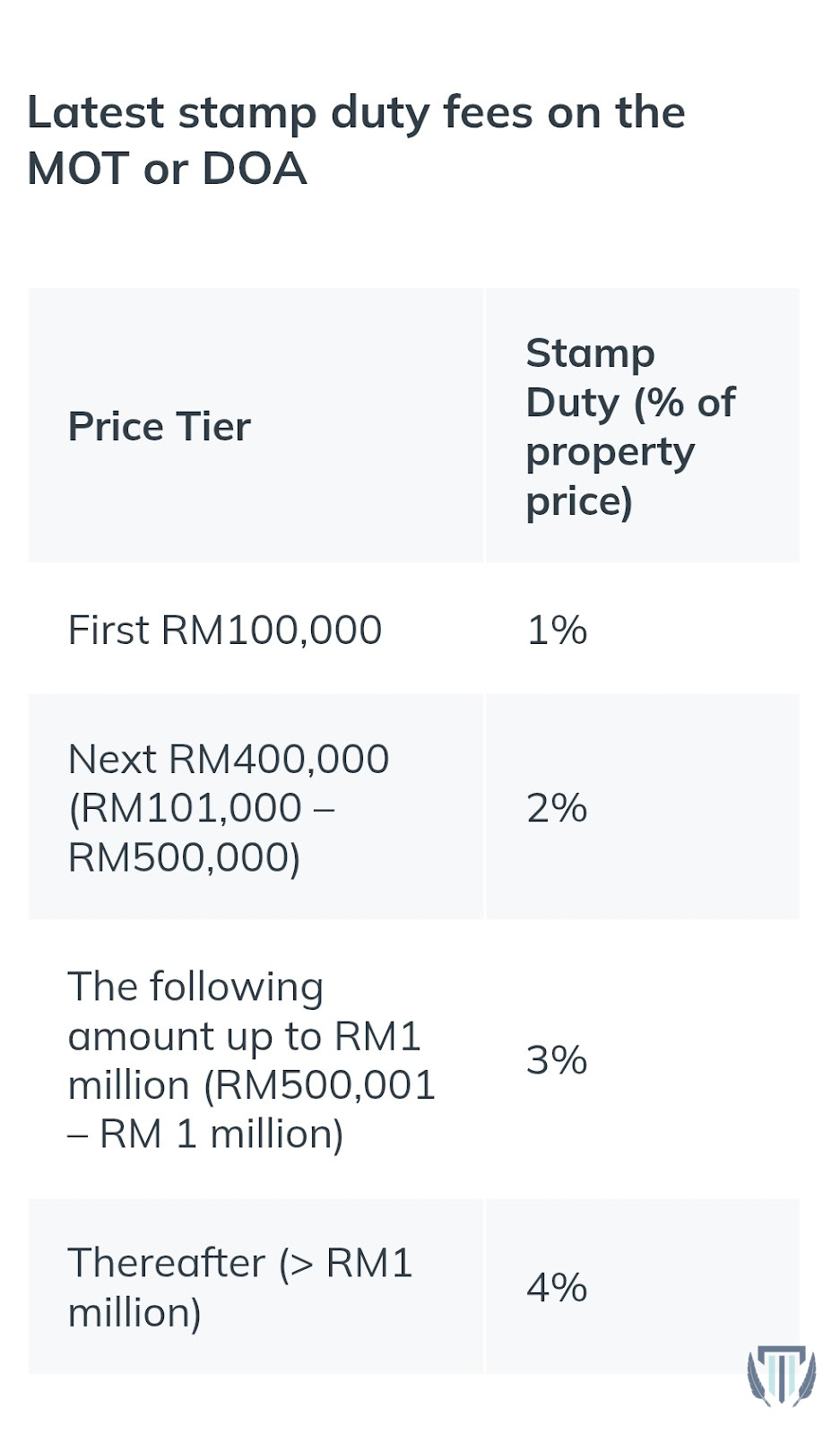

Next up are the legal proceedings and transitioning fees. Stamp duties are a form of tax imposed on selected legal documents including transfer of property. They have different rates, the stamp duty is also calculated on a tiered system, not a flat rate, so in our case it’d be RM24,000. For reference, here are the rates:

Legal fees are also required for drafting up a Sales and Purchase Agreement (SPA) and other documentation. The fee will usually be 0.4% - 1% of the property’s value, for this scenario, we’ll calculate it with 1% assuming the highest rate which would equal RM10,000. Typically, banks will also charge a fee to assess the current market when you opt for a mortgage and thus valuation costs range from RM300 to RM1,000 (varies greatly depending on the bank you choose). For our case, we’ll assume the worst and proceed with RM1,000 in valuation fees.

Even processing the loan contains a fee ranging from RM500 to RM2,000 depending on the home buyer and bank, for a first-time home buyer, the fee is likely on the lower end of that spectrum (perhaps RM1,000 shall suffice). Lastly, if a real estate agent is involved and you came across your dream home through one, then you have to fork up a maximum of 3% in real estate agent fees of your property’s value (Malaysia’s Property Summit, 2024), which will be RM30,000. That puts our sum so far at RM166,000.

Part 2: Miscellaneous fees

Legal fees and the bank aside, there are also small intricacies in the process of owning a home. First off, furniture, assuming you buy a home that’s not furnished, you will need to pay for a sofa, mattresses, a fridge, etc. and you may be looking at an estimate of RM75,000 in furnishing costs, but it can be much higher depending on the types of furnitures you procure and their conditions.

Additionally, renovations can be a wildcard too as it depends on the state of the property, but it’s safe to assume a 1 million Ringgit home will not require intensive foundation renovations but more so just minor fixings, RM15,000 would be a safe estimate. Moving costs also vary greatly but moving intracity should cost no more than 4,000 Ringgit.

Lastly, insurance is considered a monthly payment so it will be calculated into your monthly repayment. Although it’s not a part of your mortgage, it is essential to ensuring your home is adequately protected from unforeseen circumstances. Insurance can vary greatly depending on the coverage plan you choose and the value of your home but on average it’ll be RM200/month (InsuranceInfo, 2023) for a home valued at RM1 million. That puts our final total upfront payments (excluding insurance) at RM260,000.

Part 3: Affording a home mortgage

Upfront costs aside, how much does your monthly income need to be in order to afford the mortgage repayment? First off, the bank would of course charge you interest and the most common number would be around 5%+ (CIMB Bank, 2023). Additionally, to stretch it out, it's recommended you choose a repayment period (tenure) to be longer as it helps lower your monthly minimum repayment. Assuming the tenure is 30 years, the repayment amount per month would be RM4831. Combined with insurance, you’d have to set aside RM5131 monthly.

But everyone has their own set of commitments, and this is where it gets tricky. How much an individual earns to be able to afford the stated mortgage varies greatly on their lifestyle, debts, commitments, etc. and is near impossible to determine universally. For all the costs mentioned above, everything is susceptible to change, and I encourage you to engage in your own research and consult a financial consultant to be more prepared for the ever-changing economy.

Written by: Willow Sie

Edited by: Teoh Jin

P.S. We are new to Substack, please do leave a like if you’ve enjoyed our articles!